What does a Great Pitch Deck for Startup Funding look like?

- Mark Meijer

- Apr 2, 2023

- 4 min read

Updated: May 3, 2023

In this article I outline several aspects of creating a great startup pitch deck. Beginning by explaining why it is important as a tool. Then followed by outlining what it should look like and how to make it exceptional.

Creating a pitch deck is critical for startups for several reasons:

Attracting investors: A pitch deck is often the first thing that investors see when evaluating a startup. A well-crafted pitch deck can help a startup stand out and generate interest from investors.

Communicating the value proposition: A pitch deck can help a startup communicate its value proposition in a clear and concise manner. It can also help the startup articulate the problem it is solving and the unique approach it is taking to address that problem.

Focusing on the most important information: A pitch deck forces a startup to distill its business model and growth potential into a few key slides. This can help the startup focus on the most important information and avoid getting bogged down in details.

Guiding conversations: A pitch deck can serve as a framework for conversations with investors, partners, and customers. It can help ensure that everyone is on the same page and that the most important topics are covered.

Providing a roadmap: A pitch deck can help a startup develop a clear roadmap for growth and identify key milestones and metrics. This can help the startup stay focused and make progress towards its goals.

A good startup pitch deck should be a clear and concise presentation that tells a compelling story about the startup's vision, market opportunity, business model, and team.

Here are some key elements that should be included in a good startup pitch deck:

Problem: Begin by clearly articulating the problem that the startup is addressing. This should be a specific pain point that resonates with the target market.

Solution: Present the solution that the startup has developed to address the problem. This should be a clear and differentiated offering that sets the startup apart from competitors.

Market: Describe the market opportunity, including the size of the market and the target customer segment.

Business model: Explain how the startup plans to generate revenue, including the pricing strategy, distribution channels, and customer acquisition plan.

Competition: Identify the key competitors in the market and explain how the startup is different and better than these competitors.

Marketing and sales: Describe the marketing and sales strategy, including how the startup plans to acquire and retain customers.

Team: Introduce the founding team and key advisors, highlighting their relevant experience and expertise.

Financials: Provide a summary of the financial projections, including revenue, expenses, and cash flow. This should be presented in a clear and easy-to-understand format.

Ask: Clearly state the funding ask, including how much capital is being sought and what the funds will be used for.

Conclusion: End with a clear call to action and a summary of the key points.

Your pitch deck should be visually appealing, easy to follow, and should convey the passion and vision of the founders. It should be concise, with no more than 15-20 slides, and should be practiced thoroughly to ensure a smooth and confident delivery. The deck should also be customized to the audience, highlighting the aspects of the business that are most relevant to the specific investors.

Now you wonder. I want to deliver an exceptional pitch.

Making a startup pitch deck exceptional requires going beyond the basics and creating a presentation that captures the attention of investors and leaves a lasting impression. Here are some ways to make a startup pitch deck really exceptional:

Tell a compelling story: Use storytelling techniques to create a narrative that engages the audience and connects with their emotions. A story that highlights the problem, solution, and impact of the business can make the pitch more memorable and impactful.

Use visuals: Use high-quality visuals to illustrate the key points of the pitch, such as infographics, images, or videos. This can help the audience to better understand and remember the information presented.

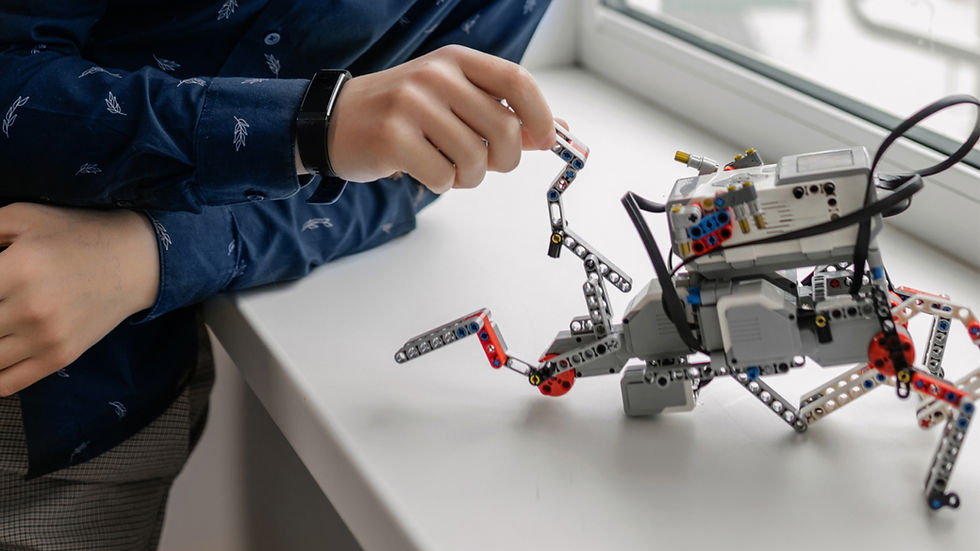

Show rather than tell: Use demos or prototypes to demonstrate the functionality of the product or service. This can help the audience to better visualize the product or service and can make the pitch more compelling.

Highlight social impact: If the business has a social or environmental impact, highlight it in the pitch deck. This can appeal to investors who are looking for businesses that make a positive impact on the world.

Showcase the team: Highlight the experience and qualifications of the team and their ability to execute the business plan. This can build confidence in the investors that the business can achieve its goals.

Use humor: Use humor or lightheartedness to create a more relaxed and engaging atmosphere. This can help to build rapport with the audience and make the pitch more memorable.

Practice, practice, practice: Practice the pitch deck thoroughly to ensure a smooth and confident delivery. This can help to build credibility and increase the chances of success.

Making a startup pitch deck exceptional requires creativity, attention to detail, and a deep understanding of the audience. By telling a compelling story, using visuals, showing rather than telling, highlighting social impact, showcasing the team, using humor, and practicing thoroughly, a startup pitch deck can stand out from the rest and increase the chances of securing funding.

While there are several important questions that VC firms typically ask during a startup pitch deck presentation, one of the most critical questions that they need to have answered is:

"What is the potential return on investment (ROI) for this opportunity?"

VC firms invest in startups with the goal of generating significant returns on their investment, so they need to have a clear understanding of the potential ROI before they can make an informed investment decision. This includes understanding the size of the market opportunity, the scalability of the business model, the potential for future growth, and the likelihood of a successful exit strategy.

In addition to addressing the potential ROI, it's also important for the startup to demonstrate that they have a strong team in place, a well-defined and validated product or service, a clear understanding of their target market and competition, and a solid plan for execution and growth.